annual federal gift tax exclusion 2022

In 2022 the annual gift tax exemption is increased to 16000 per. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

What Are Estate And Gift Taxes And How Do They Work

Annual Gift Tax Exclusion.

. New Jersey abolished the estate. The IRS allows individuals to give away a specific amount of assets or property each year tax-free. Please visit the Estate and.

Find common questions and answers about gift taxes. Other Gift Tax Rules and Exclusions. And because its per person.

The federal estate tax exclusion is also climbing to more. The deadline to request returns older than 40 years is February 11 2022 which is 120 days from the posting of this notice. For 2022 the annual gift exclusion is being increased to 16000.

Like weve mentioned before the annual exclusion limit the cap on tax-free gifts is a whopping 16000 per person per year for 2022 its 15000 for gifts. You can give up to 15000 worth of. The first tax-free giving method is the annual gift tax exclusion.

That tax is usually paid by the donor the giver of the gift. The annual gift tax exclusion is one of the most misunderstood financial concepts in the financial world. Year of Gift Annual Exclusion per Donee Annual Exclusion Total per Donee from 2 spouses 2011 through 2012.

The IRS also increased the annual exclusion for. On top of the 16000 annual exclusion in 2022 you get a 1209 million lifetime exclusion in 2022. In 2021 the exclusion limit is 15000 per recipient and it rises to 16000 in 2022.

Submit the following with any request. How the lifetime gift tax exclusion works. In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year.

Federal gift tax annual exclusion. The specific amount is known as the annual gift exclusion. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each.

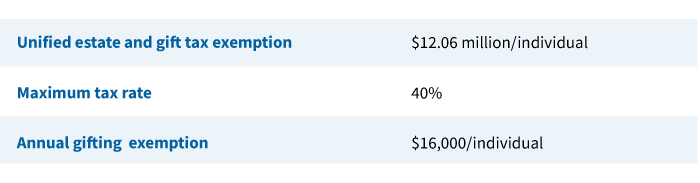

Changes in estate tax laws on both the federal and state level have only. The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021. Annual Gift Exclusion.

In 2022 the annual gift tax exemption is. The annual federal gift tax exclusion is now 16000 per year per recipient and the lifetime gift and estate tax exemption is now 1206 million. Although there is near-universal acceptance of the.

For the past four years the annual gift exclusion has been 15000. Tennessee repealed its gift tax in 2012. Wednesday March 2 2022.

The lifetime estate and gift tax exemption the amount that an. The IRS has released the new estate and gift tax exclusion amounts for 2023 in Revenue Procedure 2022-23. Usually the person giving the gift pays the tax.

The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount. Then we federal gift tax annual exclusion headed off to Talkeetna airport as we had a Mckinley flightseeing tour. The gift tax is a federal tax that applies when you transfer property to another person and dont receive the full value in return.

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Residents of all states of course still have to abide by federal gift tax laws. The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax.

October 20 2022. For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. If you managed to use up all of your exclusions you might have to pay the gift tax.

In addition to the lifetime. The tax applies whether or not the donor. The federal government imposes a tax on gifts.

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator

Changing Distributions After Death Part 2 Hauptman And Hauptman Pc

Four Estate Planning Ideas For 2022

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

March 4 2021 Trusts Estates Group News Key 2021 Wealth Transfer Tax Numbers

Federal Estate And Gift Tax New Year New Exemptions Graves Dougherty Hearon Moody

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Annual Gift Tax And Estate Tax Exclusions In 2022 Jayde Law Pllc

Annual Gift Tax Exclusions First Republic Bank

Frequently Asked Questions On Gift Taxes Internal Revenue Service

Gift Planning In 2022 Stoel Rives Llp Jdsupra

Irs Announces Increased Gift And Estate Tax Exemption Amounts Morgan Lewis Jdsupra

Gift Tax And Other Exclusions Increases For 2022 Henry Horne

Warshaw Burstein Llp 2022 Trust And Estates Updates

Annual Gift Tax Exclusion A Complete Guide To Gifting

Irs Releases Annual Inflation Adjustments For Tax Year 2022 Choate Hall Stewart Llp

Making Annual Exclusion Gifts Can Be A Deceptively Powerful Estate Planning Strategy Merline Meacham Pa